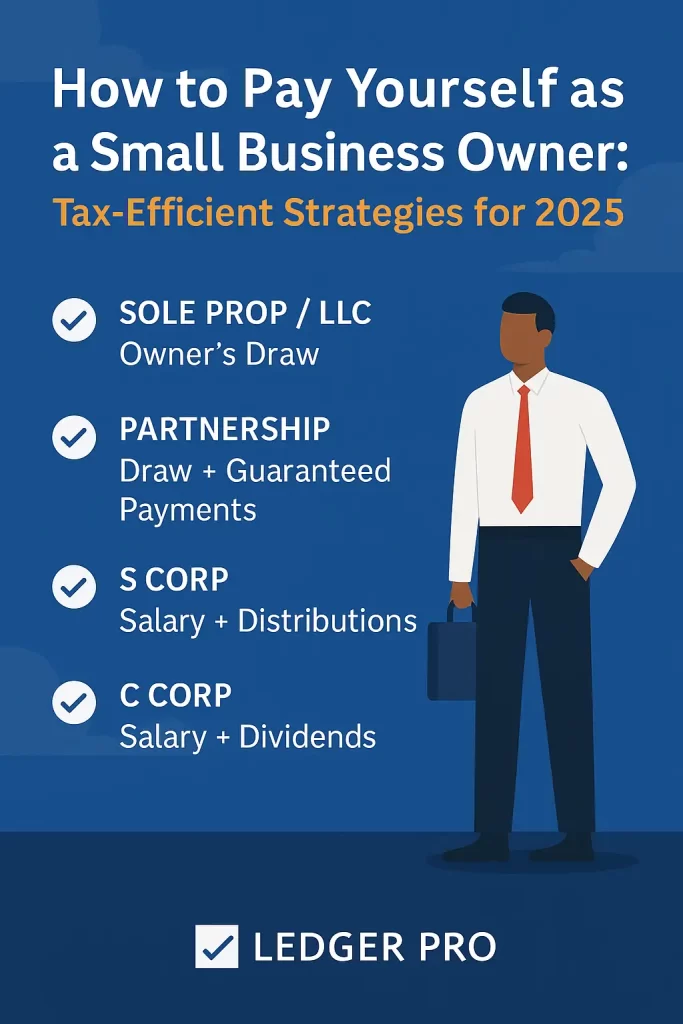

How to Pay Yourself as a Business Owner: A Guide for 2025

One of the most important tax questions to answer is how to pay yourself from your business. Whether you’re an LLC, S Corp, or sole proprietor, choosing the right method can lower your tax burden and keep you compliant with IRS rules. In this guide, we’ll explain your options by entity type and help you avoid common mistakes. Here’s how it works by business type:

👉 Sole Proprietors / Single-Member LLCs: Take owner’s draws. Report profits on Schedule C.

👉 Partnerships: Receive draws + possible guaranteed payments. Income flows through via K-1.

👉 S Corporations: Pay yourself a salary + distributions. Salary is taxed; distributions are not.

👉 C Corporations: Pay yourself via W-2 wages + (optional) dividends. Dividends are taxed twice.

Make sure your pay structure is both tax-efficient and compliant.

📞 Call (954) 906-0445 or visit www.ledgerpro.net to review your strategy.